Thursday, August 28, 2008

Doctor Settles Class Action Over Unnecessary Care

Wednesday, August 27, 2008

Indifferent Conservative Judges Try To Muzzle Dissenting Judge

On August 23, 2008, the Biloxi Sun Herald (Diaz's dissent raises ruckus) reported that the Mississippi Supreme Court attempted to suppress the dissenting opinion of Justice Oliver Diaz. Let me repeat: The Mississippi Supreme Court ordered the clerk to hide the opinion of a dissenting judge! Diaz correctly called the Mississippi Supreme Court's decision "unprecedented." I have tried cases for 30 years, and I have never seen an instance in which a court "muzzles" one of its own members. To call such behavior "unprecedented" is an understatement. It is an outrage!

Here’s what got Diaz muzzled.

The Mississippi Supreme Court tried to throw out a wrongful death case, claiming the statute of limitations had run. Curiously, the Mississippi Supreme Court said that the statute of limitations begins to run on a death claim even before the individual died. Let me repeat: The Mississippi Supreme Court said that an individual had to file his death claim before he died. Not only did the Mississippi Supreme Court have to “stretch" to deprive an individual of his rights, but in doing so it reversed 150 years of case law and insulted commonsense.

In his dissent, Justice Diaz correctly wrote that it was "absurd" to think that a claim for wrongful death must be filed before the person dies!

But there is a story behind this story. Diaz, who took the bench as a conservative, angered his fellow conservatives because he often took the part of the "little guy" and "working families," as his dissent demonstrates. For Justice Diaz fairness was more important than pandering to big business and powerful corporations. Justice Diaz wanted no part of "checkbook justice, for which he received a judicial muzzle from the indifferent colleagues.

Dark clouds have gathered for justice in America. The fabled "liberal activist judge" has been replaced by real, mean-spirited, indifferent conservative judge, proving once again that justice is a fickle thing...

Friday, August 22, 2008

Stop Union Bashing: Judge Upholds Award for GM Workers

Staff, Indianapolis Star 08/16/2008 Read Article: Indianapolis Star

Thursday, August 21, 2008

They Did It Again: AIG Wrongly Denied Claim for Veteran

American General Life Insurance Co. wrongly refused to honor a life insurance policy held by an Iraq war veteran who died while recovering from post-traumatic stress disorder, a lawsuit filed by the soldier’s parents claims. The soldier, Andrew White, joined the Marine Corps Reserve in July 2003 and served as a combat engineer, disarming "improvised explosive devices" and patrolling areas near Iraq's border with Syria.

Denying the claim, AIG has cited a previously undisclosed car accident involving the soldier as the reason for denying the claim. The lawsuit seeks the full value of the policy and other unspecified damages.

Ah...it's in their nature to find any reason not to pay! They're addicted to "bad faith."

Andrew Clevenger, The Charleston Gazette 08/18/2008 Read Article: The Charleston Gazette

Wednesday, August 20, 2008

Bad Guys Lose: American National General Insurance Company Hit For $60 Million in Punitive Damages

A Utah jury awarded compensatory damages of more than $3 million and punitive damages of $60 million in a case involving deflection of another company's insurance agents. Texas-based American National Insurance Company and its subsidiaries American National Property and Casualty Company and American National General Insurance Company say they intend to ask for a retrial of all issues.

Tuesday, August 19, 2008

Guess Who's Running America's Hospitals

Here's a pop quiz: Guess who's running America's hospitals?

If you said, doctors, you're wrong.

If you said, public health experts, you're wrong again.

But if you said, MBAs, you're right!

Business school graduates have replaced doctors and public health experts as CEOs of hospitals, at patients' expense. A shift that has its origin in the 1970s has evolved into a complete turnabout from the days when doctors ran hospitals. Read the article here. Maggie Mahar, Health Beat, 08/15/2008.

Monday, August 18, 2008

Amerigroup Corp. Settles Medicaid Fraud Claims For $225 Million

Next time you hear that lawsuits against negligent doctors drive up the cost of medical care in the U.S, think fraud. Think, Amerigroup Corporation.

Amerigroup claims to be "the leading publicly-traded company dedicated exclusively to caring for the financially vulnerable, seniors and people with disabilities through publicly-funded programs."

Ah yes..."caring for the financially vulnerable, seniors and people with disabilities," right!

Recently, Amerigroup Corporation agreed to pay $225 million to settle federal and state claims that it defrauded the Illinois Medicaid program. The company is accused of "systematically avoiding enrolling pregnant women and unhealthy patients" because they are more expensive to treat.

So much for "the financially vulnerable, seniors and people with disabilities."

PRNewswire, PR Newswire 08/14/2008 Read Article: PR Newswire

Sunday, August 17, 2008

If Your Daughter Has Been Rape At Halliburton, She May Have to Arbitrate Her Rape

But now-a-days, Big Business doesn't "play fair;" they want a "stacked deck." They want a sure thing, a winning hand, especially when it comes to justice. But, this can be difficult to get when juries call the shots. So, how does Big Business stack the deck when it comes to justice? It's easy! Simply let an indifferent conservative court force arbitration.

The conservative indifferent U.S. Supreme Court has expanded a 1925 law to a level no member of Congress ever thought possible. They have allowed Big Business to create corporate owned kangaroo courts.

Corporate-owned companies like the National Arbitration Forum prostitute justice by limiting the liability of Big Business to insure that corporate dirty linen stays out of public courtrooms, hidden in the dark world of back room deals called mandatory arbitration.

Mandatory arbitration hides all manner of financial chicanery, and all manner of abuse of workers. Including rape! Just ask Jamie Jones.

Jamie Leigh Jones was 19 and working for Halliburton/KBR in Houston when she volunteered to go to Iraq. Four days after she arrived, she was drugged and gang-raped. Her enemy wasn't rebel militias, but thugs employed by KBR. Jamie sued. But KBR said, "No way the public hears these stories in court. This goes to arbitration."

Ah, justice is a fickle thing...

Saturday, August 16, 2008

Surprise, Surprise: U.S. Supreme Court Favors Corporations During Last Term

Finally, it's funny how "state sovereignty" is important except when states protect life over corporate profit. Then, the matter becomes federal preemtion and states must back off. While forced arbitration, especially in consumer cases, continues to undermine justice in America. See, National Arbitration Forum. Rent-A-Judge! How Arbitration Is Undermining Justice for Consumers

Thursday, August 14, 2008

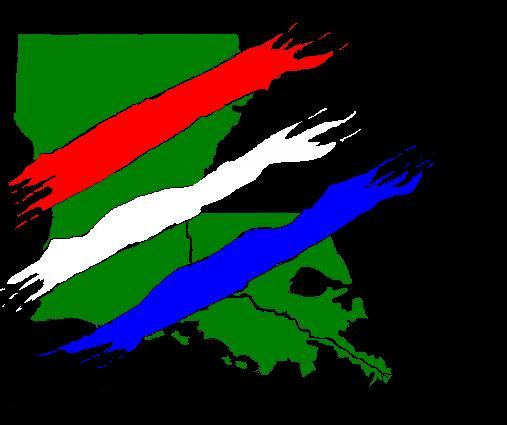

Some Who Settled Katrina Damage Can't Sue State Farm For Fraud

The plaintiff, Eldridge Boyd, sued State Farm in June 2007, claiming State Farm "conspired with adjusters and engineers to underpay wind claims." Boyd said he was owed for additional damage because he knew nothing about the "conspiracy" when he went through mediation.

Judge Santer said, "No!"

The shame is that any agreement based on "fraud" isn't fair and isn't just. Insurance companies shouldn't be allowed to profit by their own fraudulent wrongdoing.

This case is another example of indifferent conservative judges who protect corporations!

The opinion was issued in the case Boyd v. State Farm. Anita Lee, Biloxi Sun Herald 08/13/2008 Read Article: Biloxi Sun Herald

Tuesday, August 12, 2008

Ford Motor Caught Cheating Again!

Monday, August 11, 2008

Universal Healthcare Now! Chronically Ill Often Go Without Care

Friday, August 08, 2008

State Farm Settles with Mississippi Attorney General

State Farm had previously refused to comply with a January agreement requiring the insurer to reevaluate homeowner claims. The original deal could have required Allstate to pay as much as $400 million in additional claims. Staff and Wire Reports, The Jackson Clarion-Ledger 08/07/2008 Read Article: The Jackson Clarion-Ledger