In England, the Star Chamber (Camera stellata) reigned from 1487 to 1641 when it was abloished. It wasn’t a tribunal of justice. Rather, it was political and not unlike many courts of today.

In England, the Star Chamber (Camera stellata) reigned from 1487 to 1641 when it was abloished. It wasn’t a tribunal of justice. Rather, it was political and not unlike many courts of today.I’ve litigated against insurance companies for 30 years. The fraud and deceit that goes on daily in civil courtrooms across America is appalling. Until recently, most judges were on the side of working folks; they actually looked out for workingmen and workingwomen.

Not so any more. Thing have changed.

The federal courts make it expensive and difficult for workingmen and workingwomen to find justice there. For all practical purposes, federal courts purposely skew the rules in favor of insurance companies and big corporations. Judges in the federal system are appointed for life, so there’s no way to get them out.

Insurance companies and big corporations are slowly dominating the state courts. Like their federal counterparts, state courts are a sanctuary for bad faith corporate and insurance practices.

From time to time my Star Chamber segment will show case the abuses that stem from “pocketbook justice,” where money rather than justice reigns.

This posting of Star Chamber looks at State Farm Insurance Company.

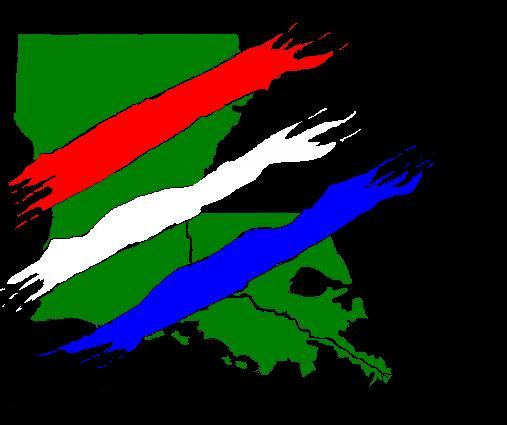

State Farm Insurance Companies is being pounded in Louisiana, Mississippi, Oklahoma, and rightly so. State Farm’s been accused of hiring an engineering firm that “fixed” its reports to support State Farm’s defense. See: Documents That Suggest Fraud by Insurance Companies in the Handling of Katrina Wind and Water Claims

Now, it’s inconceivable that courts in America let State Farm get away with this type of unfair and unjust behavior, but they do. Does America have an independent judiciary or a star chamber?